Economic research increasingly integrates data-driven techniques to improve forecasting accuracy, policy design, and behavioral understanding. Machine learning (ML) has emerged as a transformative tool in this field, enabling economists to analyze complex patterns, large datasets, and nonlinear relationships that traditional econometric models often overlook. By automating prediction, classification, and decision-making, machine learning provides new ways to evaluate economic systems and human interactions. The combination of economic theory and ML techniques is reshaping the way economists study markets, labor, finance, and development.

Table of Contents

Understanding Machine Learning in Economics

- Definition: Machine learning is a branch of artificial intelligence that uses algorithms to identify patterns and make predictions from data without explicit programming.

- Purpose in Economics: To enhance predictive power, uncover hidden relationships, and test models on high-dimensional datasets.

- Integration with Econometrics: While econometrics focuses on causal inference, ML emphasizes prediction and pattern recognition, making both approaches complementary.

Key Machine Learning Techniques Used by Economists

| Technique | Function | Economic Application Example |

|---|---|---|

| Regression Trees and Random Forests | Predict outcomes using hierarchical decision splits. | Forecasting income inequality or consumption patterns. |

| Support Vector Machines (SVM) | Classify data into categories by finding the best separating boundary. | Detecting credit default risks in banking. |

| Neural Networks | Model complex nonlinear relationships. | Predicting stock prices or inflation trends. |

| Clustering (K-Means, Hierarchical) | Group similar observations based on shared characteristics. | Segmenting consumers in labor or housing markets. |

| Natural Language Processing (NLP) | Analyze and extract meaning from textual data. | Studying financial news or public policy sentiment. |

| Reinforcement Learning | Learn optimal policies through trial and feedback. | Modeling dynamic pricing or adaptive policy responses. |

Advantages of Machine Learning in Economic Research

- Enhanced Predictive Accuracy: ML algorithms outperform traditional models in forecasting demand, prices, or growth rates.

- Handling Big Data: Ability to process large and unstructured datasets from multiple sources.

- Pattern Discovery: Identifies hidden relationships among variables without explicit assumptions.

- Automation: Reduces manual computation through self-improving algorithms.

- Flexibility: Adapts to changing data trends, making it suitable for dynamic economic systems.

Applications of Machine Learning Across Economic Fields

1. Macroeconomics and Forecasting

- ML models improve accuracy in predicting GDP growth, inflation, and unemployment.

- Central banks use ML for early warning signals on recessions.

- Combining traditional time-series analysis with neural networks enhances stability predictions.

2. Labor Economics

- Algorithms analyze job postings, resumes, and wage data to study skill demand.

- Predictive models assess employment trends in response to automation or policy shifts.

- Clustering techniques identify regional labor market structures.

3. Development Economics

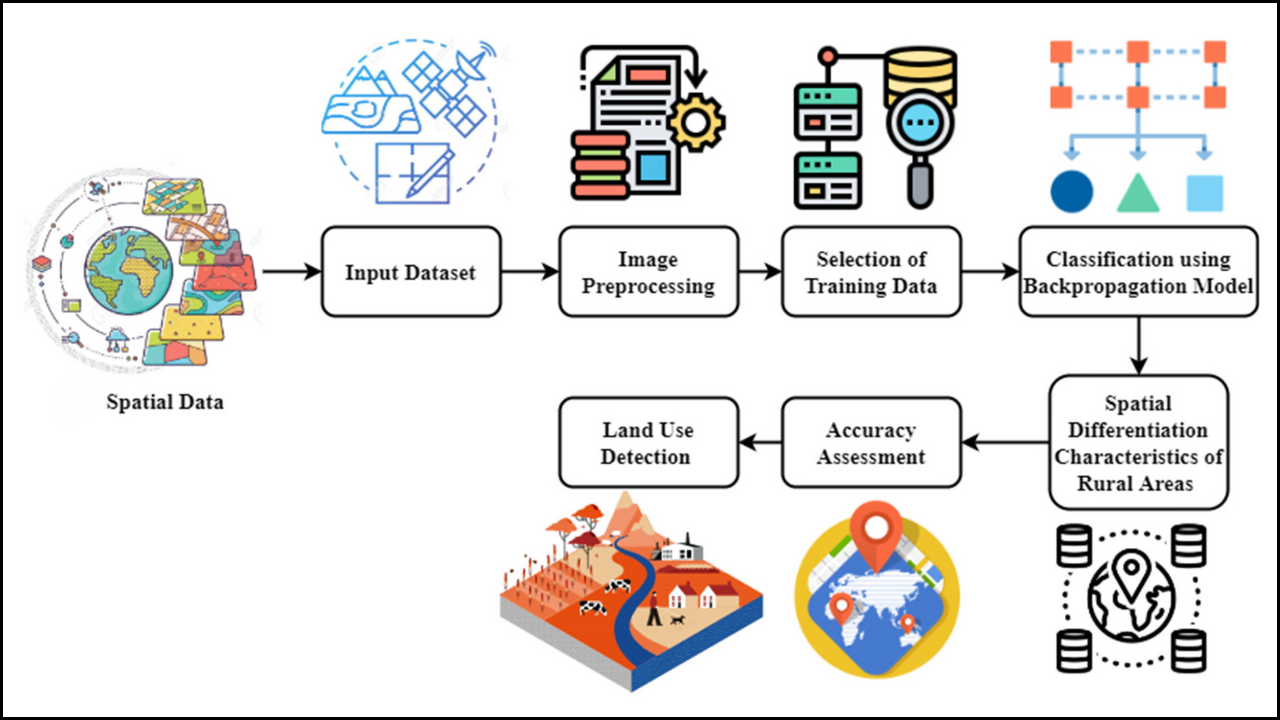

- Satellite and mobile data predict poverty, agricultural yields, and infrastructure needs.

- ML assists in evaluating microfinance performance and targeting social programs.

- Predictive analytics support policy design in the education and healthcare sectors.

4. Finance and Banking

- Credit scoring models predict loan default probabilities with higher precision.

- ML-powered trading algorithms analyze real-time market signals for investment decisions.

- Fraud detection systems use anomaly detection techniques to prevent financial crimes.

5. Behavioral and Experimental Economics

- Neural networks model consumer preferences and decision-making biases.

- Sentiment analysis measures trust, risk perception, and economic optimism from surveys and social media.

- Reinforcement learning models simulate human behavior in auctions or game theory contexts.

Data Sources Used in Machine Learning-Based Economic Analysis

- Administrative Records: Tax filings, education data, and healthcare statistics.

- Survey Data: Household income, consumption, and employment surveys.

- Satellite Imagery: Used to estimate crop yields, urban growth, and poverty distribution.

- Digital Data: Mobile payments, e-commerce transactions, and online search trends.

- Textual Data: News articles, government reports, and social media content for NLP models.

Machine Learning Applications in Key Economic Areas

| Economic Field | Application | ML Technique Used |

|---|---|---|

| Finance | Stock market forecasting and fraud detection | Neural Networks, SVM |

| Labor Economics | Wage prediction and job market segmentation | Regression Trees, Clustering |

| Development Economics | Poverty mapping using satellite data | Random Forests, CNNs |

| Public Policy | Social welfare targeting and budget allocation | Decision Trees, Gradient Boosting |

| Trade and Industry | Predicting export competitiveness | Ensemble Learning |

| Environmental Economics | Estimating pollution impact and climate change trends | Deep Learning, Time-Series ML |

Challenges of Using Machine Learning in Economics

- Causal Inference Limitations: ML emphasizes prediction rather than identifying cause-and-effect relationships.

- Data Bias: Biased input data can lead to misleading outcomes and reinforce inequality.

- Model Interpretability: Complex algorithms, especially deep learning, often act as “black boxes.”

- Ethical Concerns: Privacy issues arise when using personal or sensitive data.

- Computational Demand: High processing power and advanced infrastructure are required.

Combining Machine Learning and Econometrics

- Hybrid Approaches: Economists combine ML’s predictive strength with econometrics’ causal analysis to achieve both accuracy and interpretability.

- Causal Machine Learning Models: Methods like Double Machine Learning (DML) and causal forests bridge the gap between prediction and inference.

- Policy Simulation: ML-generated predictions are integrated into policy models to forecast long-term effects.

- Model Validation: Econometric tests are used to confirm ML findings.

Examples of Machine Learning in Economic Research

- Poverty Prediction (Jean et al., 2016): Satellite images analyzed using convolutional neural networks estimated poverty levels in African countries.

- Inflation Forecasting (Bank of England): ML models incorporated financial indicators to improve policy response timing.

- Tax Evasion Detection: Governments use anomaly detection algorithms to identify fraudulent financial activities.

- Consumer Sentiment Analysis: NLP-based models track public opinion on inflation or employment trends.

- Labor Market Automation (World Bank): Predictive models assess which occupations face displacement due to technological change.

Ethical and Policy Considerations

- Transparency: Policymakers must understand how ML models make decisions.

- Fairness: Algorithms must be checked for bias that could disadvantage certain groups.

- Data Security: Protection of personal and financial data remains a priority.

- Accountability: Clear responsibility must be established for ML-driven policy outcomes.

- Public Access: Open data initiatives help democratize ML-based economic research.

Comparison Between Traditional Econometrics and Machine Learning

| Aspect | Traditional Econometrics | Machine Learning |

|---|---|---|

| Focus | Causal inference | Prediction and pattern recognition |

| Model Assumptions | Strong theoretical structure | Flexible, data-driven |

| Data Size | Small to medium datasets | Large and unstructured datasets |

| Interpretability | High | Moderate to low |

| Accuracy | Depends on model fit | High due to adaptive algorithms |

| Application Scope | Narrow (specific relationships) | Broad (multiple data types) |

Future Directions of Machine Learning in Economics

- Explainable AI (XAI): Enhances interpretability for policymakers and researchers.

- Integration with Big Data Platforms: Expands capacity to handle real-time information flows.

- Automated Policy Design: AI-based simulations could suggest optimal policy interventions.

- Sustainability Analytics: ML applied to measure climate resilience and green investments.

- Behavioral Modeling: Deep learning to simulate market reactions and consumer psychology.

Wrapping Up

Machine learning is redefining how economists approach data, analyze trends, and test theories. Its strength lies in prediction, adaptability, and scalability—features crucial in an era of complex economic interdependencies. While traditional econometrics remains essential for causal analysis, machine learning offers new pathways for innovation in forecasting, financial modeling, and public policy design. The fusion of these disciplines ensures that future economic research remains both empirically rigorous and technologically advanced, paving the way for more informed and responsive decision-making in a rapidly changing world.