Remittances represent one of the most important financial lifelines for developing economies. Money sent home by migrant workers supports millions of families, contributes to national income, and drives social change. An economy with a high volume of remittance inflows often experiences visible growth in consumption, investment, and education levels. However, the effects of remittances are complex, influencing both short-term welfare and long-term development dynamics. Understanding their economic, social, and institutional impacts helps reveal how remittances reshape the structure of local economies.

Table of Contents

Definition and Nature of Remittances

- Remittances refer to financial transfers made by individuals working abroad to their families or communities in their home countries.

- They can take the form of direct cash transfers, goods, or investments.

- The World Bank identifies remittances as one of the largest sources of foreign capital for low- and middle-income countries, surpassing foreign direct investment in several regions.

- These funds usually flow through formal banking systems, money transfer services, or informal channels.

Economic Importance of Remittances

- A significant share of remittance income contributes to household spending on food, education, and healthcare.

- In several developing countries, remittances stabilize national balance of payments and strengthen foreign currency reserves.

- Economies like the Philippines, Nepal, and Bangladesh rely heavily on these inflows to maintain fiscal stability.

- The predictability of remittance flows helps mitigate the volatility of foreign investments and aid.

Major Remittance-Receiving Countries (2024 Estimates)

| Country | Remittance Inflows (USD Billion) | Share of GDP (%) | Economic Impact |

|---|---|---|---|

| India | 125 | 3.4 | Increased rural consumption and digital banking penetration |

| Mexico | 63 | 4.0 | Boosted housing investments and small businesses |

| Philippines | 40 | 9.4 | Supported education and health sectors |

| Egypt | 32 | 7.6 | Stabilized foreign reserves and reduced poverty |

| Bangladesh | 23 | 6.5 | Improved agricultural productivity through private investment |

Remittances and Household Welfare

- Remittances improve household living standards by providing a steady source of income.

- Families use the money to upgrade housing, access better healthcare, and fund children’s education.

- Financial stability encourages savings and enhances creditworthiness, allowing rural families to participate in local financial systems.

- In regions affected by droughts or economic downturns, remittances serve as a safety net that reduces vulnerability.

Employment and Entrepreneurship Effects

- Increased income from remittances often finances small-scale entrepreneurship in rural and semi-urban areas.

- Family members invest in local businesses, retail outlets, or agriculture-based ventures.

- Access to remittance income lowers dependence on subsistence farming, leading to greater occupational diversification.

- However, excessive reliance on remittances may discourage labor market participation, particularly among youth.

Examples of Remittance-Funded Enterprises

| Sector | Type of Enterprise | Benefits | Challenges |

|---|---|---|---|

| Agriculture | Dairy farms, seed distribution units | Increased productivity and employment | Requires business training |

| Retail | Grocery shops, textile outlets | Local market development | Limited scalability |

| Services | Transport, education, and repair services | Enhanced accessibility in villages | Infrastructure constraints |

| Real Estate | Home construction and rentals | Asset creation and urban growth | Risk of speculation |

Social and Cultural Impacts of Remittances

- Regular inflows of remittances reshape consumption patterns and lifestyle aspirations.

- Education becomes a key investment priority, leading to better literacy rates and skill development.

- Social mobility increases as families achieve financial independence and expand social networks.

- Gender roles shift as women often manage remittance funds, gaining greater financial autonomy.

Regional Development and Inequality

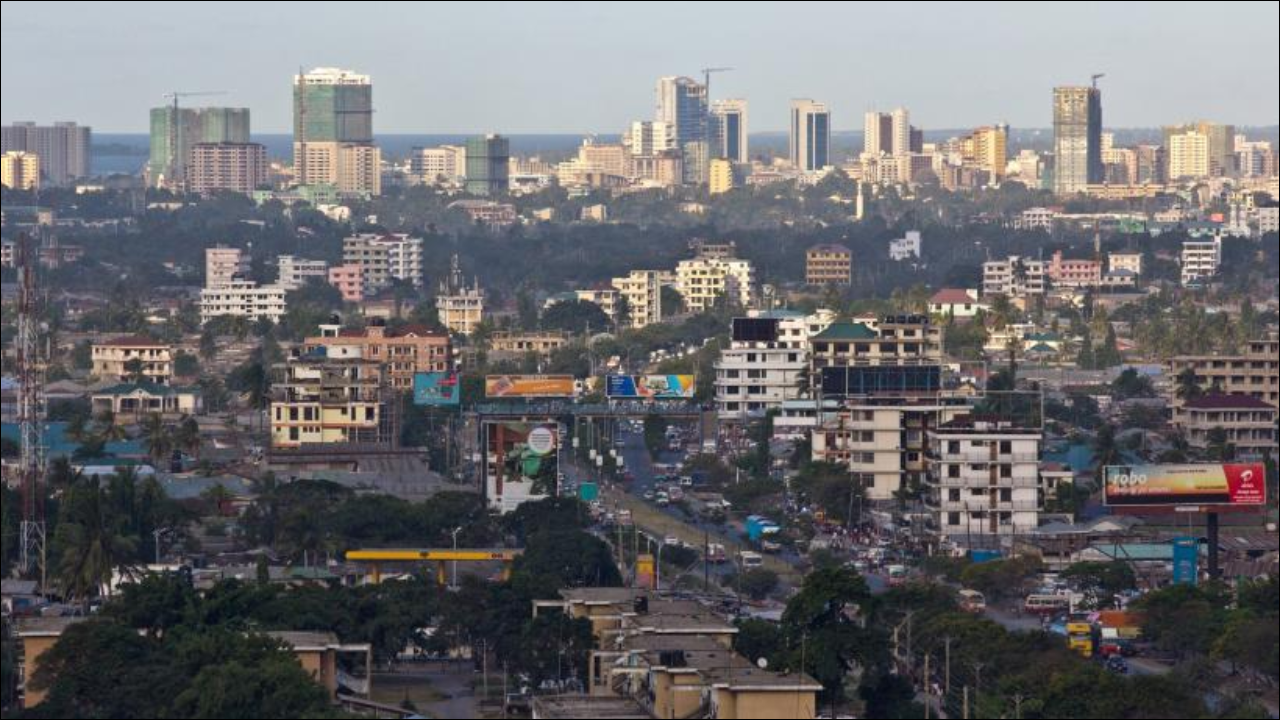

- Regions with high migration rates often experience rapid development due to remittance inflows.

- Infrastructure improves through household and community-level investments in housing, schools, and clinics.

- However, uneven remittance distribution can widen regional disparities, with migrant-rich areas advancing faster than others.

- Policymakers must ensure balanced regional planning to avoid urban-rural divides.

Monetary and Macroeconomic Effects

- Remittances strengthen domestic currency reserves, reducing dependence on external borrowing.

- Central banks often use remittance inflows to stabilize exchange rates and inflation levels.

- A steady inflow contributes to financial sector deepening through increased bank deposits and remittance-linked savings accounts.

- Yet, excessive inflows can create inflationary pressures and reduce export competitiveness, known as the “Dutch Disease” effect.

Government Policy and Institutional Support

- Governments promote formal remittance channels through reduced transfer fees and simplified banking regulations.

- Partnerships with microfinance institutions encourage remittance-backed credit for small entrepreneurs.

- Diaspora bonds and investment funds help channel remittance savings into infrastructure and industry.

- Effective policy frameworks ensure remittance inflows contribute to productive investments rather than mere consumption.

Policy Initiatives Supporting Remittance Utilization

| Country | Initiative | Objective | Outcome |

|---|---|---|---|

| Philippines | OFW Reintegration Program | Encourage entrepreneurship among returning workers | Creation of MSMEs in provinces |

| Bangladesh | Wage Earners’ Development Bond | Mobilize remittance savings for national projects | Increased infrastructure funding |

| Nepal | Remittance Investment Fund | Channel funds into productive sectors | Boosted rural employment |

| Mexico | 3×1 Program for Migrants | Match migrant investments with public funds | Improved local development infrastructure |

Challenges in Managing Remittance Flows

- High transaction fees and limited financial literacy hinder effective remittance use.

- Informal transfer systems pose risks of fraud and data untraceability.

- Lack of investment opportunities in rural areas leads to unproductive spending.

- Migration dependency can cause demographic imbalances, with working-age populations moving abroad.

- Global economic slowdowns or policy changes in host countries may reduce inflows, impacting local economies.

Long-Term Development Prospects

- Remittances can catalyze inclusive growth when directed toward education, entrepreneurship, and innovation.

- Integration of remittance data into national financial systems enhances planning and forecasting.

- Partnerships between banks, governments, and diaspora communities can transform remittances into development capital.

- Sustainable outcomes depend on financial literacy programs, equitable access to credit, and transparent governance.

Moving Forward

Remittances form a cornerstone of financial resilience in many developing economies. A stable flow of funds strengthens household welfare, promotes entrepreneurship, and supports regional development. However, the true potential of remittances lies not in consumption but in productive investment that nurtures long-term economic transformation. Strong institutional frameworks, inclusive policies, and financial awareness can turn remittances from personal transfers into a national growth engine. A balanced approach ensures that these financial flows empower communities while contributing to sustainable development across local economies.